Mr. Macro came across something that might draw a chuckle or two. Back in 2001 the Congressional Budget Office predicted that over the next decade the government would run constant budget surpluses and all of the existing Treasury debt could be redeemed. It is safe to say that they did not envision the economic meltdown and the brave new world of ever-expanding government deficits. Forecasting is not an exact science. Did the CBO guys get a bonus in 2001? Speaking of forecasting, Mr. Macro has a rather strange modus operandi – start with the conclusion and work backwards to discover reasons to justify it. The current view is that the risk rally is over. The major reasons for this call are:

1.An economic recovery is not sustainable. Fiscal stimulus and a rebuilding of inventories may lead to a much better outcome for 2Q09 GDP, but growth should slide once again in 2H.

2.The fiscal stimulus is not large enough to offset the hit to consumption and investment.

3.A forward-looking Taylor rule says monetary policy is tightening every day as inflation recedes and unemployment continues to march toward double digits. Does $1trn of balance sheet expansion equate to 100bp of rate cuts? The BOJ debated this and there is no consensus. For example, buying Treasuries is a lot different than lending at the discount window.

4.The paradigm has shifted. Increased government involvement, future tax hikes, regulation and less leverage are obstacles to growth. Meanwhile, debt-to-income levels are much too high and must normalize. This makes it very different than the old paradigm. No longer can the Fed ease monetary conditions and induce consumers and business to take on more leverage. Increasing savings is the new, new thing. Higher savings comes at the expense of growth.

5.China is a nice story, but cannot possibly save the day. It is not big enough. Neither should we expect a “Green” bubble to be the answer.

6.The Geithner bank plan is a half-measure. Some major banks need to be nationalized. Today, he said banks have more regulatory capital than they need. Note the key word in that sentence is “regulatory”. Mr. Macro cannot believe the market rallied on that, but then again it was “Turnaround Tuesday.”

7.Never shy to make a point or two, the IMF says US-originated assets over the 2007-2010 periods could total $2.7 trillion, up from $1.4 trillion in the October GFSR. It went on to say, “if banks were to bring forward to today loss provisions for the next two years, before expected earnings, US and European banks in aggregate would have tangible common equity close to zero”. In order to reduce leverage to pre-crisis levels, US banks would require a total equity injection of $275bn. Cutting leverage to mid-1990s levels would require $500bn in additional equity.

8.A related question is how to get private capital to participate. Converted preferred to common is tantamount to a dilution. Another fear is creating a separate class of bond holder above private investors. Governments recent flip flops have done a lot to destroy investor confidence and increase uncertainty.

9.The overriding obstacle is that there is a lack of political will to do more. President Obama and the Democratic leadership should struggle to get more funds for a second fiscal stimulus, or TARP2, to inject more needed capital into banks. The over-riding issue is a populist one – how much of the cost of bailing out this generation should be placed on future generations?

10.Additionally, Simon Johnson, a former IMF top economist, has pointed out that the chummy relationship between Washington and Wall Street amounts to “crony capitalism.” Sooner or later, the taxpayer is going to call time on this arrangement.

11.It is an almost impossible task of balancing the interests of the three stake holders – banks, investors, and taxpayers. In short, that is the crux of the problem. Tax payers are not going to like it if their coupon paying preferred gets converted to common. Geithner may hope they do not notice, but don’t count on it.

Investment Conclusions Sell Stocks – early and often

Bunds – there is no substitute

Invest in a cave and buy canned goods, a survivalist life-style is the new bubble.

We are positive development for Indofood (INDF IJ), who acquired milk company Indolakto at the beginning of 2009.

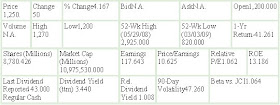

We are positive development for Indofood (INDF IJ), who acquired milk company Indolakto at the beginning of 2009.  INDF:IJ Chart

INDF:IJ Chart JAKCONS:IND Chart

JAKCONS:IND Chart