With the release of the bank stress tests now behind us, and with Treasury supply now a known regular quantity, the key to the market outlook has become the actions of the Federal Reserve. In particular, the Fed is torn between prioritizing the implementation of a mortgage prepayment wave, versus planning for an exit strategy for its quantitative easing policy. We think the risks of yields continuing to move higher in the next several weeks are substantial and might provoke a Fed response. Thus we shift to a duration neutral stance, from our previous overweight stance.

With the release of the bank stress tests now behind us, and with Treasury supply now a known regular quantity, the key to the market outlook has become the actions of the Federal Reserve. In particular, the Fed is torn between prioritizing the implementation of a mortgage prepayment wave, versus planning for an exit strategy for its quantitative easing policy. We think the risks of yields continuing to move higher in the next several weeks are substantial and might provoke a Fed response. Thus we shift to a duration neutral stance, from our previous overweight stance. Previously, we had thought that the Fed’s priority in keeping yields low would have overridden other considerations, and that the Fed would do whatever it took to keep yields low, but the events of the past week have led us to reconsider. In the face of rising yields this past week, the Fed only increased its Treasury purchases by a modest amount of around 20% of the previous operation in the same sector. This modest increase had little effect and Treasury yields continued to rise.

In addition, Fed Chairman Bernanke in his recent congressional testimony emphasized the importance of the “exit strategy” from his quantitative easing operations, and even said that the Fed didn’t have a yield target. The implementation of the exit strategy would consist of a number of different possibilities: reverse repos, SFP bill issuance, raising the interest rate on excess reserves, and outright sales. Increasing the size of the Fed’s purchases substantially might make the exit strategy more difficult to implement, and thus could hurt market confidence, particularly in the context of an economy that has shown signs of bottoming sometime in the near future.

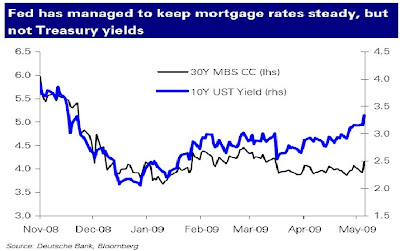

Given the Fed’s constraints, we expect the market to test the Fed’s determination to keep yields low. In the short term, the risk of a continuation of the trend toward higher Treasury yields is substantial, although we think the Fed will be able to keep mortgage rates from rising an equivalent amount, at least for the near term. The fact that low yields haven’t sparked a refi wave is an additional factor that could lead the Fed to be less aggressive for now. Thus the Fed might be constrained against increasing purchase sizes substantially, until the FOMC meets again and decides whether keeping yields low outweighs the efforts to plan for a smooth exit strategy.

For at least the next several weeks, the Fed’s communications regarding what it views as the prospects for the economy, and thus how much it would weigh the importance of keeping the exit strategy in the forefront of planning, will be crucial for the market direction. To the extent that the Fed focuses on economic recovery, there will be little pushback from the Fed if the market decides to focus on eventual Fed tightening, thus resulting in higher Treasury yields. But if the Fed instead underlines its determination to keep monetary policy in an aggressively accommodative stance, it could be a signal that the capacity to buy mortgages and Treasuries could be added to if needed.

Tidak ada komentar:

Posting Komentar