NEW YORK (Reuters) - Stocks climbed more than 1 percent on Thursday as higher oil prices drove up energy shares and falling yields in the bond market eased concerns that higher borrowing costs would hinder economic recovery.

NEW YORK (Reuters) - Stocks climbed more than 1 percent on Thursday as higher oil prices drove up energy shares and falling yields in the bond market eased concerns that higher borrowing costs would hinder economic recovery.Energy company shares, including Exxon Mobil Corp (XOM.N), rose as U.S. crude oil settled above $65 a barrel for its highest close since November, 64boosted by a drop in crude inventories last week.

"We had the OPEC meeting today, plus we had inventory numbers, and both were favorable for oil. That's helping that whole sector," said Owen Fitzpatrick, head of U.S. Equity Group at Deutsche Bank Private Wealth Management in New York. OPEC decided to hold production at current levels.

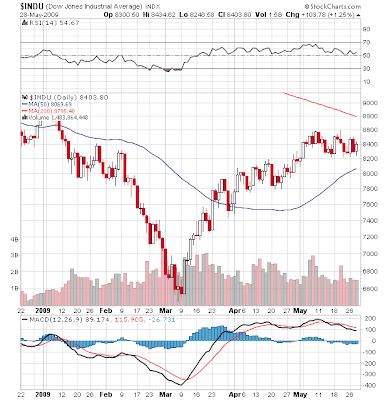

The Dow Jones industrial average .DJI gained 103.78 points, or 1.25 percent, to finish at 8,403.80. The Standard & Poor's 500 Index .SPX was up 13.77 points, or 1.54 percent, at 906.83. The Nasdaq Composite Index .IXIC was up 20.71 points, or 1.20 percent, at 1,751.79.

Equities recovered Wednesday's losses, extending gains late in the session.

After the market's close, shares of computer maker Dell Inc (DELL.O) rose more than 1 percent to $11.61 after its results narrowly beat analysts' estimates.

The U.S. bond market also rebounded as benchmark 10-year notes bounced 24/32 higher for a yield of 3.64 percent, 10 basis points lower on the day, after an auction of $26 billion in new seven-year Treasury notes. Another Treasury auction on Wednesday helped fuel selling of bonds and stocks as investors worried about expanding U.S. government debt.

Investors have grown concerned that rising bond yields, which move inversely to bond prices, portend a possible rise in borrowing costs, which could choke a much-anticipated economic recovery.

Hopes that the economy may be stabilizing helped stocks recover from 12-year lows of early March, but since early this month the market's rebound has been a bit bumpier. Still, at Thursday's close, the S&P 500 was up 34 percent since the March 9 low. more...