CPO

Last week we called CPO Shares especially Astra Agro Lestari and Bakrie Sumatera Plantation. The reason was the increase of export and decrease of CPO stockpile. AALI gained around 10% in 4th day but UNSP stuck, cause by sentiment on groups.

What’s next?

We still believe that average CPO price will rise caused by continuing demand from China and India, low stockpile and stress yield production. We believe that in a couple week CPO Price will run to $570 or around RM2100. Our view is positive for CPO price until 1H09. But we think AALI slightly premium at the sector.

We start looking LSIP. LSIP had total area more than 70 K Ha, mature plantation more than 57 K Ha, EV/Ha around 3411. But don’t forget, we also like UNSP but it will have more risk.

INDF

INDFIn the balance sheet, INDF is highly leveraged with net debt-to-equity ratio of 78.8% in 9M08. As of 9M08, INDF had US$784mn exposure from debt and payables, while having US$433mn of cash and receivable.

The net exposure of US$351mn would create in forex loss.

The negative factor is; highly leveraged, possible goodwill impairment from Lonsum and Indolakto acquisitions, large exposure on US$ payables would result in forex loss if rupiah weaken.

In our view all negative factor was price in right now. For the next, we think INDF have a potential rebound cause by good CPO Price. INDF had 165,853 Ha planted area palm oil with 122.151 mature. In the other hand, we believe that wheat had a limited down side and we also predict wheat price could rebound due to contraction on production in US at 1H’09. We predict condition in US production area remain drier than normal in a couple weeks. INDF business was edible oil 30%, Wheat (bogasari) 31%, Consumer 27% and Distribution 12%.

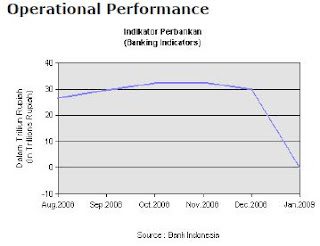

Will Bank Operating Performance Get Worse?

Bank

Operating Cost bank starts minus as January 2009. Losses of operating cost caused by low credit exposure, risk from Nonperforming Loan and decreasing of Net Interest Margin. The Operating losses on banking sector is about idr301 bio. PNL from operating is one of indicator for bank performance as well as lending credit, forex transaction and financing.

Operating performance of banking sector on January 2009 decreased YoY. This situation caused by global financial crisis. Since Q4’08 banking sector had some problems with their lending exposure. Lending growth was negative 2.1% MoM. NPL was up to 4.24% from 4% MoM. Deposit rate still high around 12-13% cause by interbank liquidity is still tight.

Last week the banking shares had a good performance. BMRI up 4.55%, BBRI up 6.49% and BBCA up 9.70%, thanks to financial issue on regional especially from Citibank. But we still see some risk on our banking sector. Increasing NPL, decreasing NIM and operating performance is our concern. We think Bank with high variable bonds exposure will under pressure like BMRI and BBCA. BBRI is our top pick.

Overall we put neutral on banking sector with sell on strength recommendation.

[Just Personal Opinion]

=====================================================================================

DISCLAIMER: This report is issued by [BRIGHT INFO]. Although the contents of this document may represent the opinion of [BRIGHT INFO]. We cannot guarantee its accuracy and completeness.

Tidak ada komentar:

Posting Komentar